Irs Schedule C Instructions 2025. We will update this page for tax year 2025 as the forms, schedules, and instructions become available. An activity qualifies as a business if your primary.

This is 2025 schedule c guide. Schedule c details all of the income and expenses incurred by.

Irs Schedule C Instructions 2025 Images References :

Source: teressawalie.pages.dev

Source: teressawalie.pages.dev

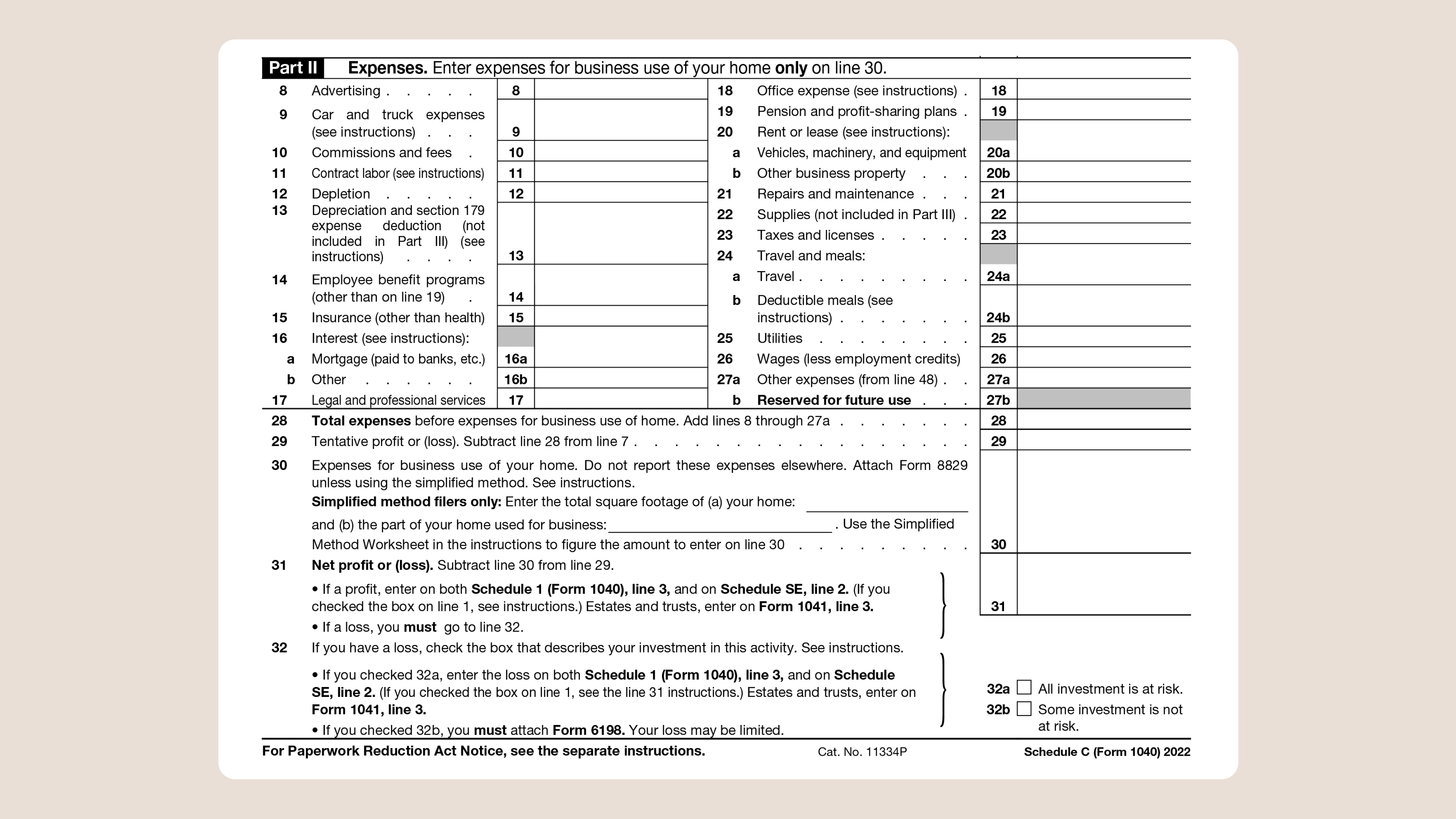

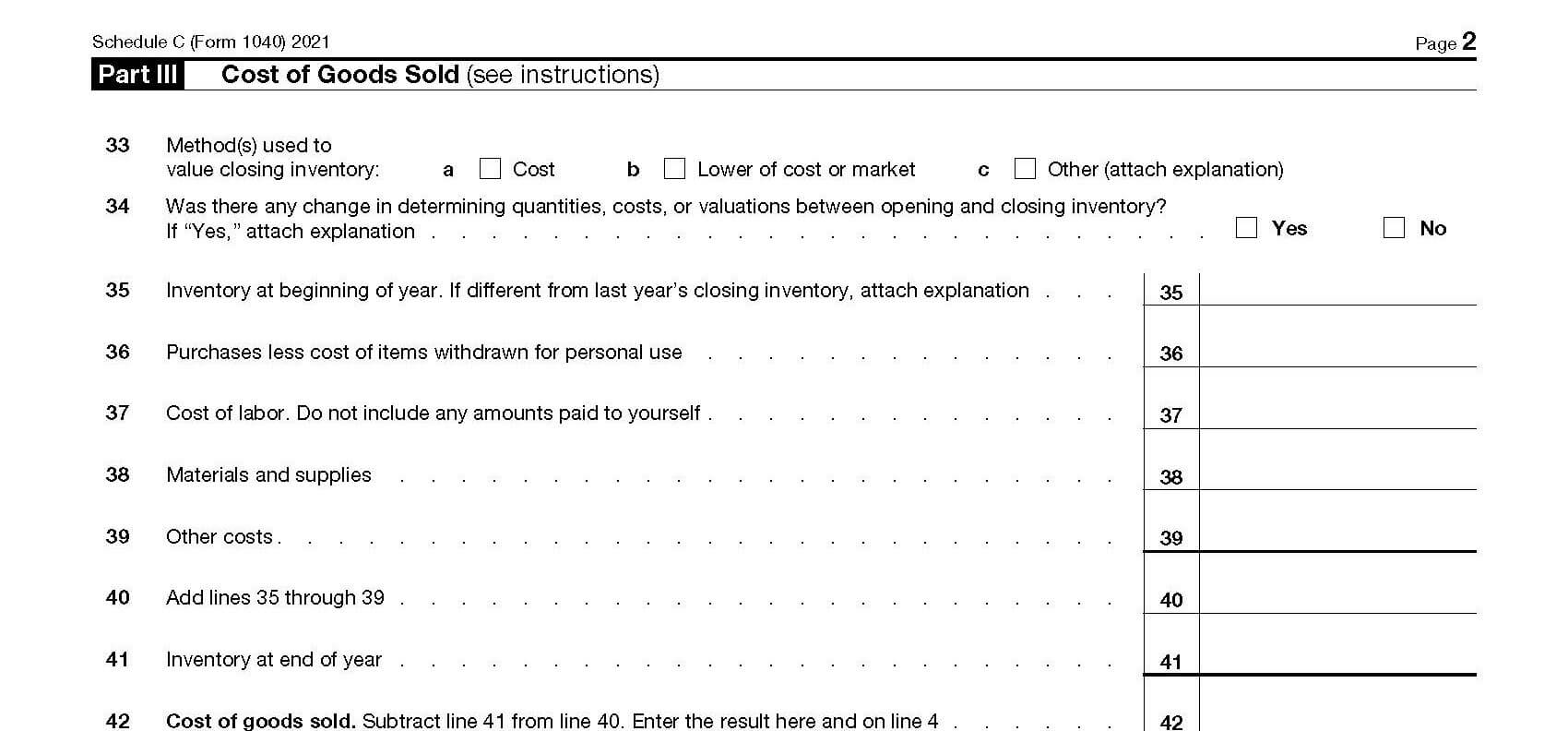

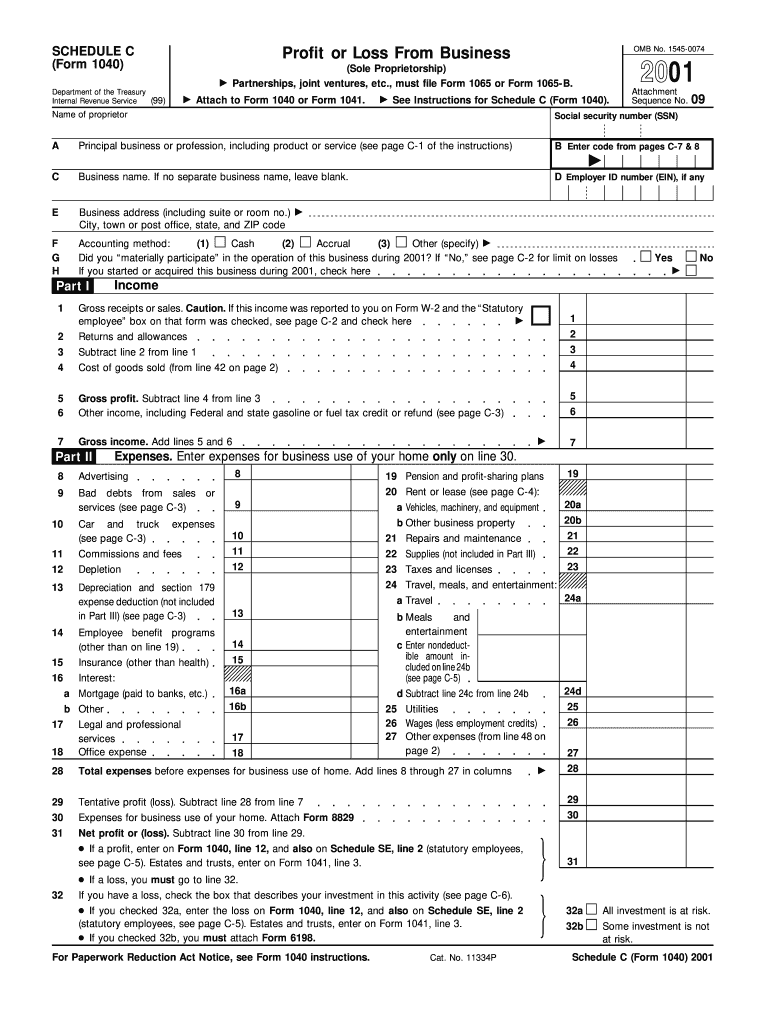

2025 Schedule C Instructions Polly Camellia, Schedule c is an irs tax form that reports profit or loss (income and expenses) from a business.

Source: goldiabchandal.pages.dev

Source: goldiabchandal.pages.dev

2025 Schedule C Lacy Shanie, 22, 2024, the irs announced the annual inflation adjustments for 2025.

Source: www.taxdefensenetwork.com

Source: www.taxdefensenetwork.com

How to Complete IRS Schedule C, Profit or loss from business (form 1040)?

Source: printableherndon.z21.web.core.windows.net

Source: printableherndon.z21.web.core.windows.net

Schedule C Worksheets, An activity qualifies as a business if your primary.

Source: www.teachmepersonalfinance.com

Source: www.teachmepersonalfinance.com

IRS Schedule C Instructions Business Profit or Loss, The irs uses the information in the schedule c tax form to calculate how much taxable profit you made—and assess any taxes or refunds owing.

Source: kymmaryellen.pages.dev

Source: kymmaryellen.pages.dev

Form 1040 Instructions 2025 Tamma Fidelity, The internal revenue service (irs) has released its full list of changing tax rules for 2025, and americans are likely to see major updates to standard deductions and certain.

Source: www.teachmepersonalfinance.com

Source: www.teachmepersonalfinance.com

IRS Schedule C Instructions Business Profit or Loss, A handful of tax provisions, including the standard deduction and tax brackets, will see new limits and.

Source: www.teachmepersonalfinance.com

Source: www.teachmepersonalfinance.com

IRS Schedule C Instructions Business Profit or Loss, Schedule c is an irs tax form that reports profit or loss (income and expenses) from a business.

Source: jobinawpaule.pages.dev

Source: jobinawpaule.pages.dev

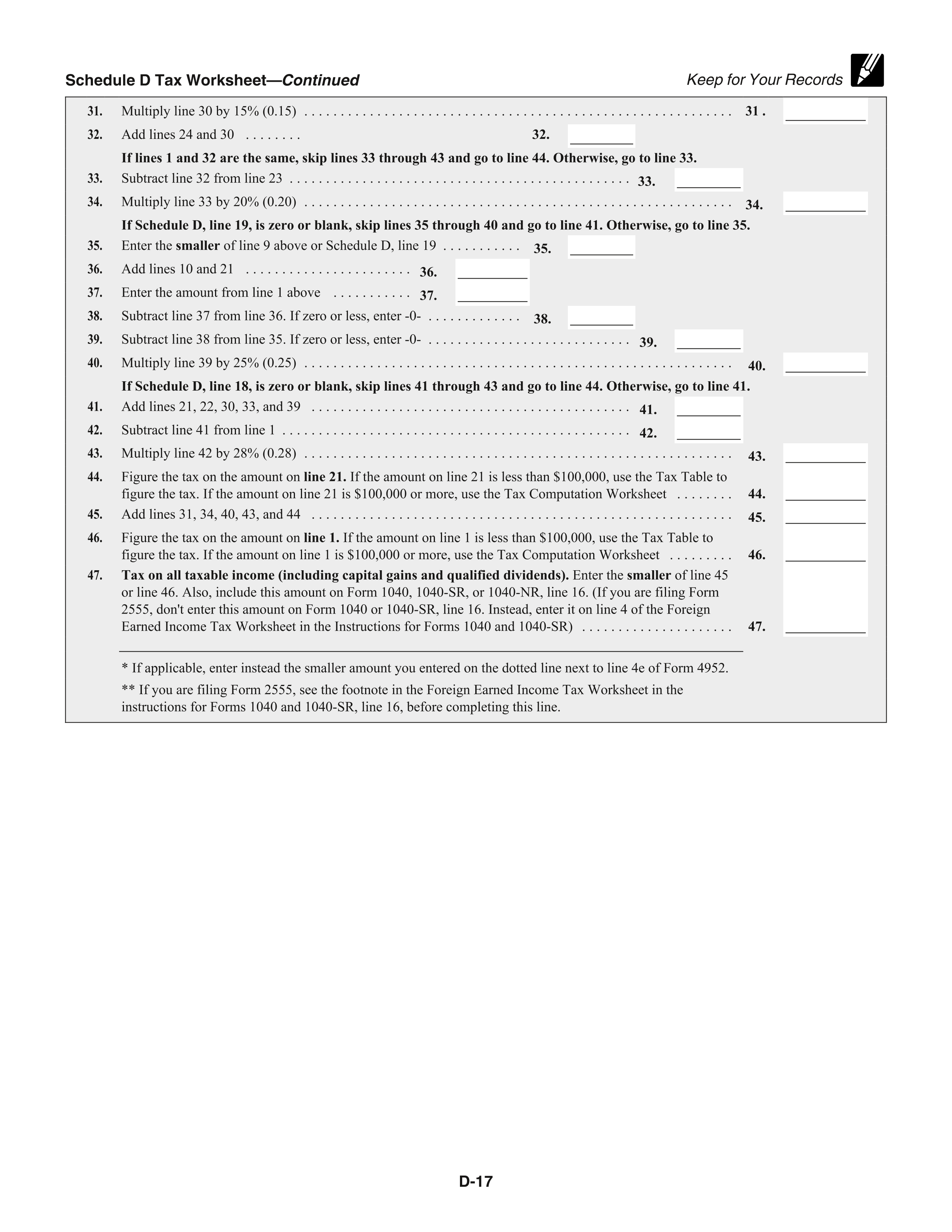

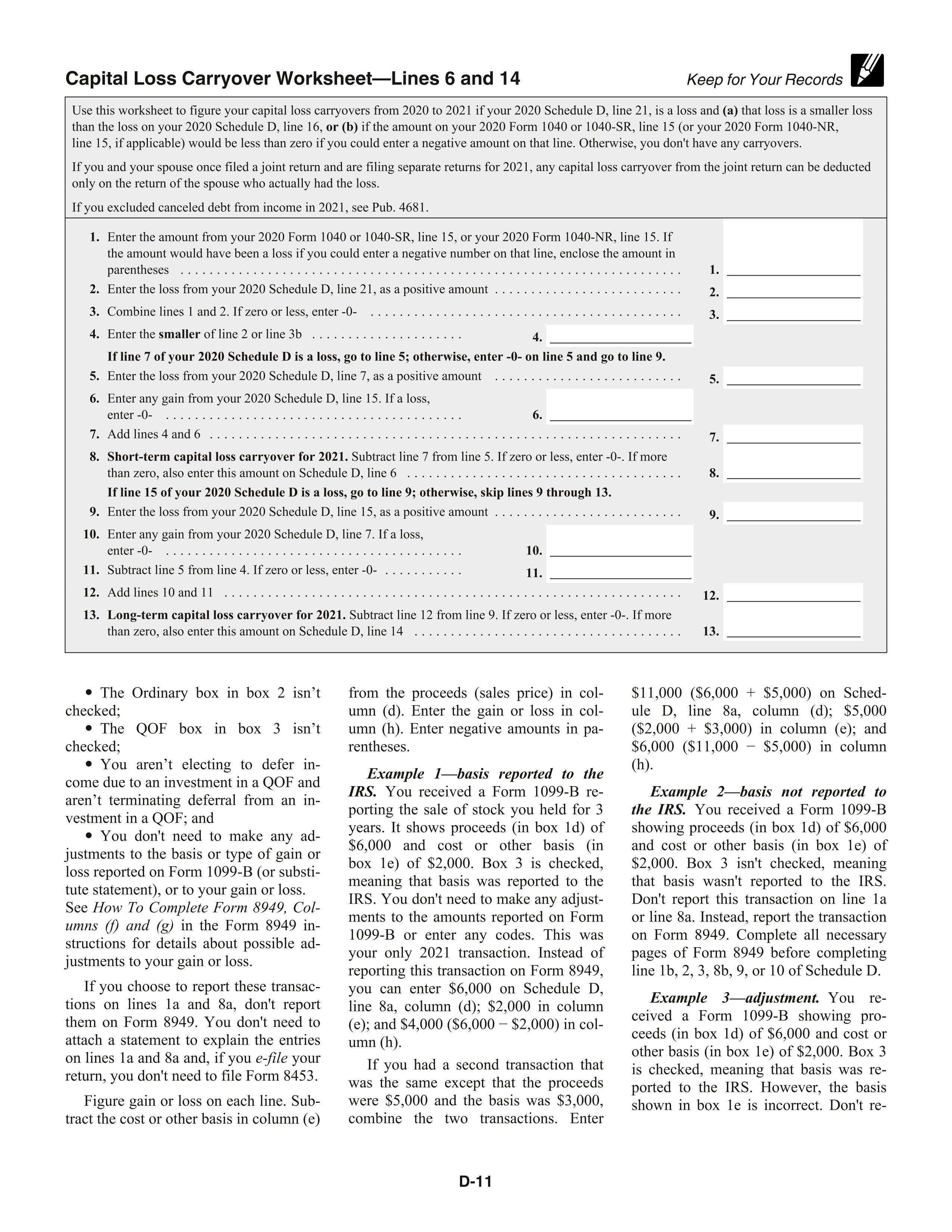

2025 Instructions For Schedule D Sam Leslie, The internal revenue service (irs) has released its full list of changing tax rules for 2025, and americans are likely to see major updates to standard deductions and certain.

Source: estellycosetta.pages.dev

Source: estellycosetta.pages.dev

Irs Schedule D Instructions 2025 Casi, The last thing you want is to file your taxes wrong and end up dealing with some kind of irs issue.